Unlocking Efficiency in Trade Finance

How I contributed to this project by designing a platform that streamlined trade finance, increasing efficiency, reducing manual work, and enhancing user experience while prioritizing security and transparency.

YEAR

Mid 2022—Early 2023

PLATFORM

Web and Mobile

MY ROLE

Senior Product Designer

The Company

Fishtail is a provider of trade finance solutions, leveraging technology to enhance efficiency and transparency in global trade.

My Role

My role was lead product designer for the borrower side of this project. I collaborated with product designers and product managers throughout this project.

Challenge

The trade finance industry was plagued by inefficient manual processes, lack of transparency, fragmented systems, and limited investment opportunities. These challenges hindered the efficiency, security, and accessibility of trade finance for all stakeholders, including trade finance managers, borrowers, and investors.

Research Process

To better understand the problem, it was needed to conduct a investigation and it started with the research.

It was crucial to understand the current manual workflows of trade finance managers and borrowers. This involved conducting both qualitative and quantitative research to gather a comprehensive understanding of their needs and requirements.

Quantitative research

I used a serie of surveys and online forms to gather data on the frequency and severity of the users challenges. The research also involved a review of industry-standard tools such as manual spreadsheets, email, and paper-based documentation systems, as well as a comprehensive analysis of the current manual workflows.

Qualitative research

I conducted interviews with trade finance managers and borrowers and also used the shadowing method to understand the challenges and pain points experienced in their manual workflows.

Findings

During the research process, I found several pain points and challenges experienced by the users.

Excessive Manual Workflows

Traditional trade finance often involves a lot of manual work, which can lead to delays, errors, and increased risk.

Lack of Transparency

Not knowing what's happening at each step in the trade finance process limits trust and collaboration between banks and their customers.

Fragmented Systems

Using many different systems to manage trade finance is confusing, time-consuming and, sometimes, inefficient. When these systems don't work well together, it can create major problems.

Inadequate Data Management

If data isn't organized and managed well, it's difficult to access, analyze, and use it to make good decisions. Poor data management can lead to serious problems.

Decisions

The research results provided a clear picture of the challenges and pain points experienced by trade finance managers and borrowers in their manual workflows and helped to inform the design and development of the platform.

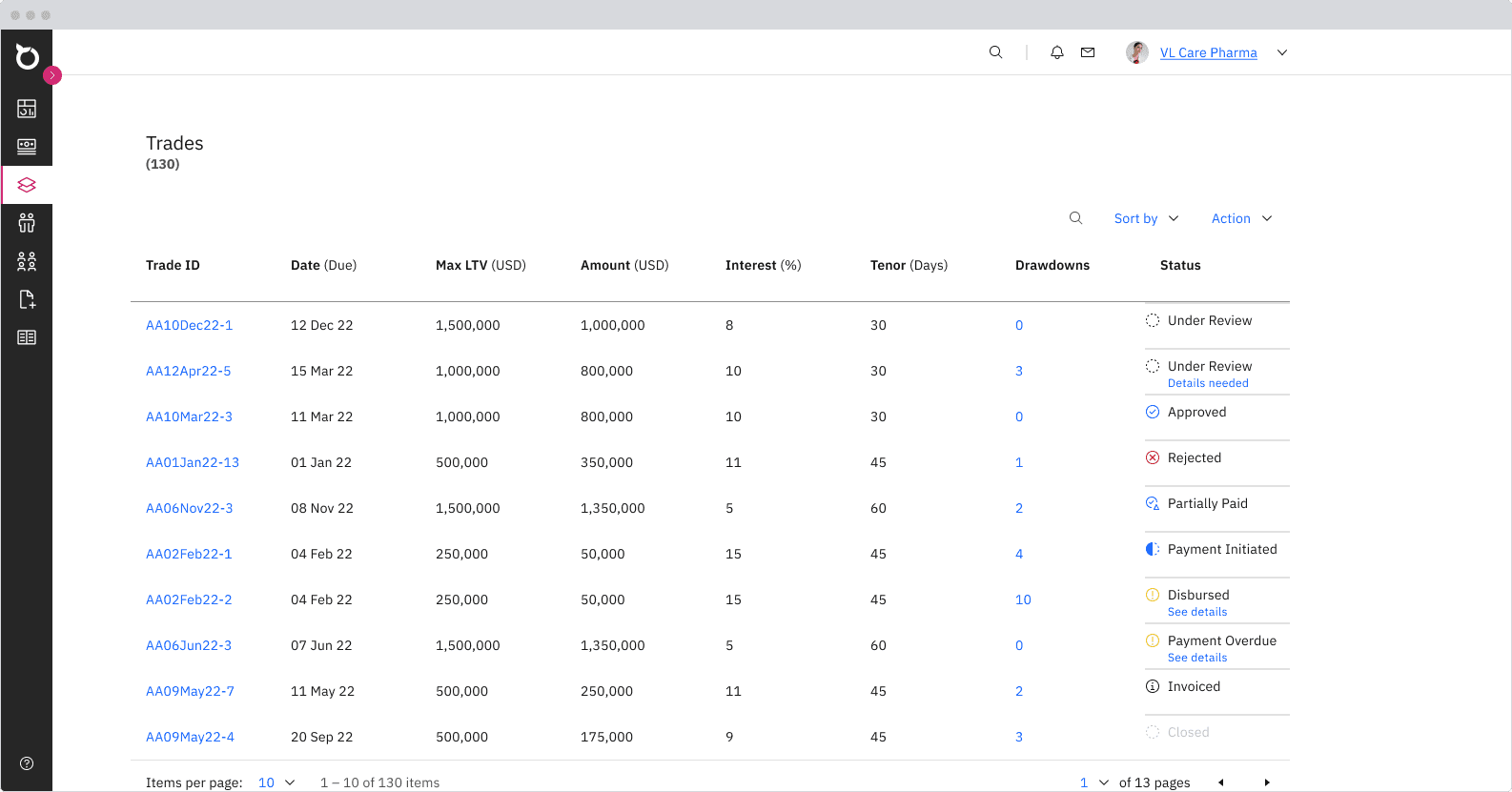

Clear and Easy-to-Read Information

Clearly display all important information in a simple and easy-to-find format.

Track Progress Easily

Always show the latest status of the trade and make it easy to see important dates related to the trade.

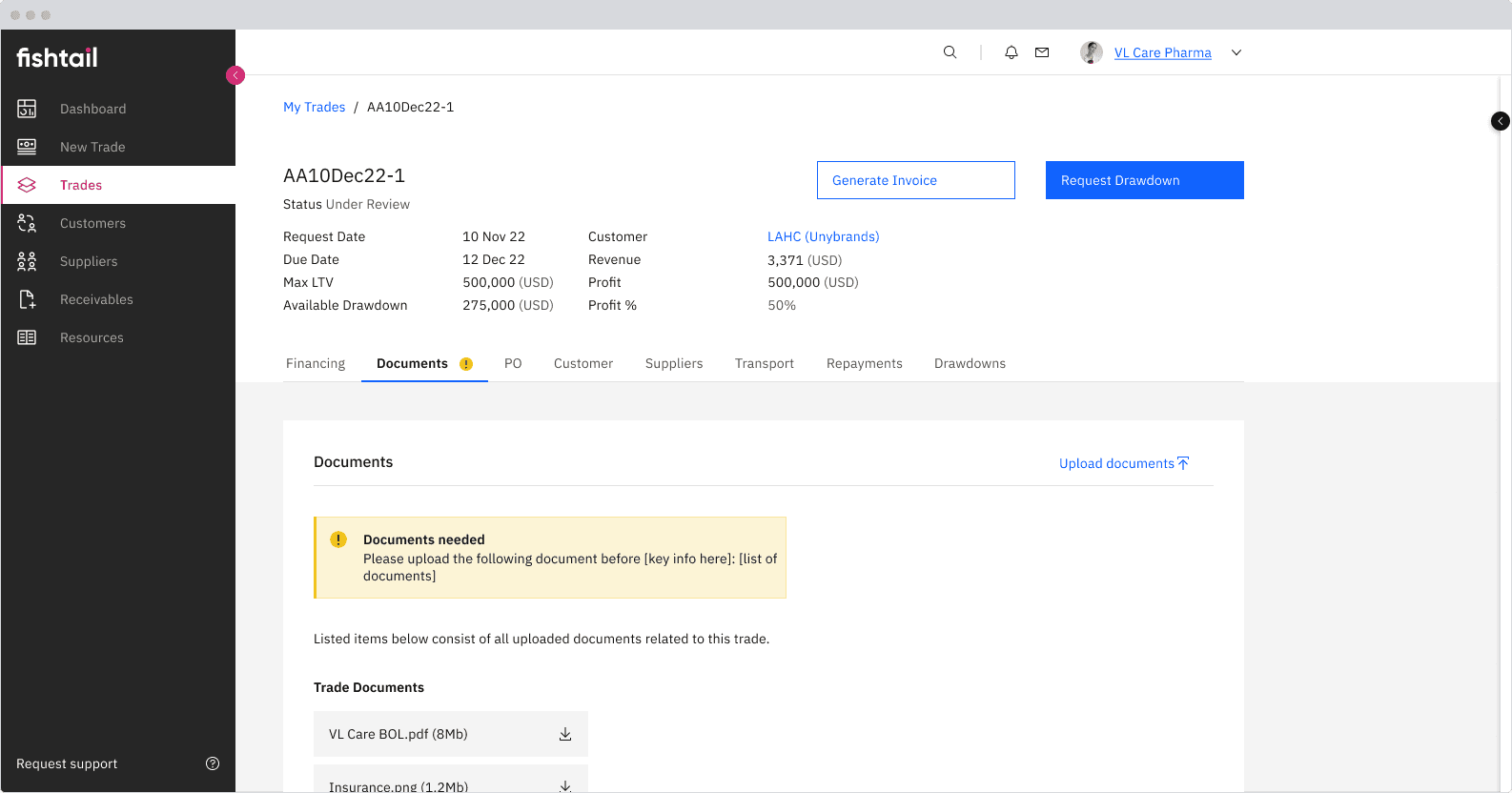

Manage Documents Efficiently

Allow trade finance managers to easily see, review and verify the authenticity of all the necessary documents.

Handle Financing Requests

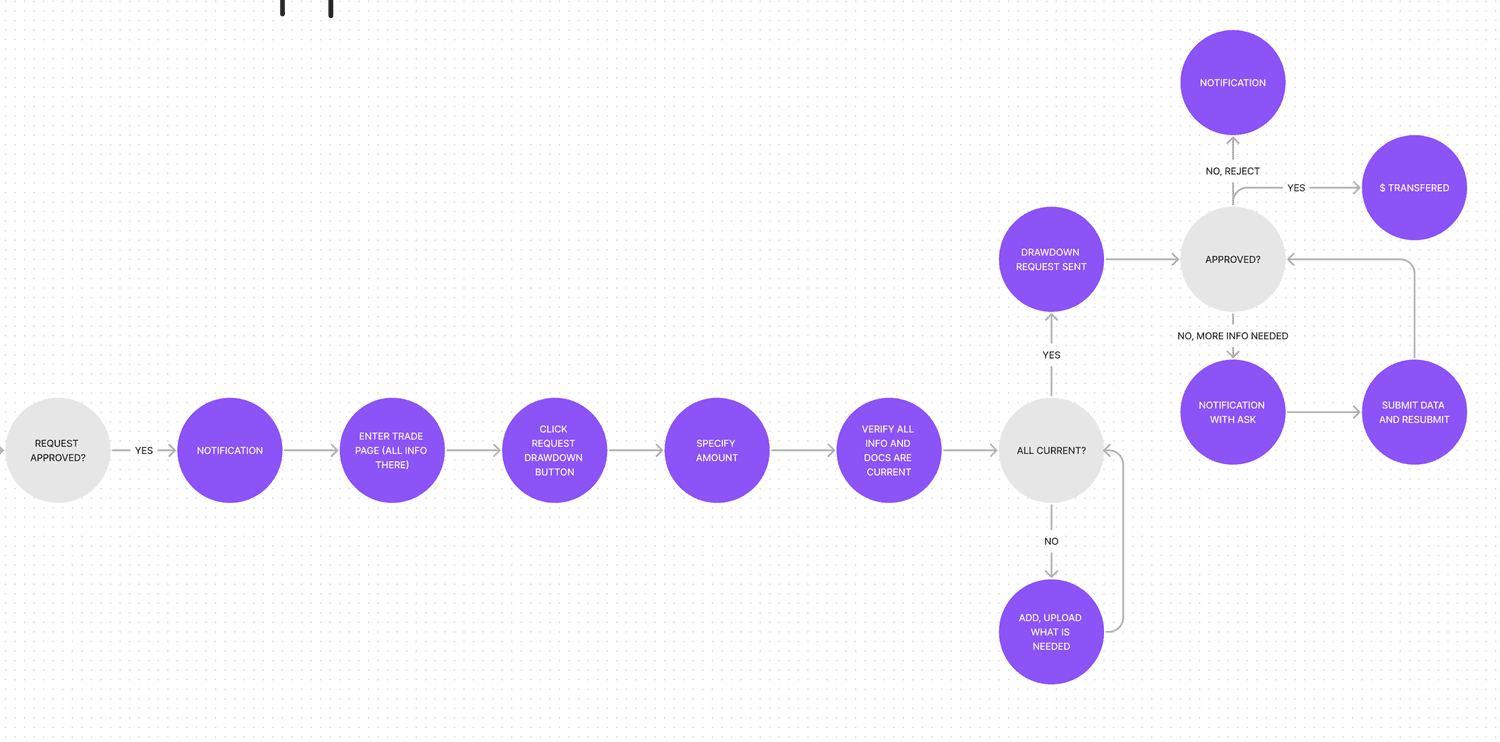

The financing request process should be simple and easy to understand. Trade finance managers must be able to easily review all relevant information and quickly approve or reject financing requests.

Assess and Manage Risk

Trade finance managers need to easily assess and score the risk associated with each trade. This risk assessment and score should be clearly visible within the details of each trade.

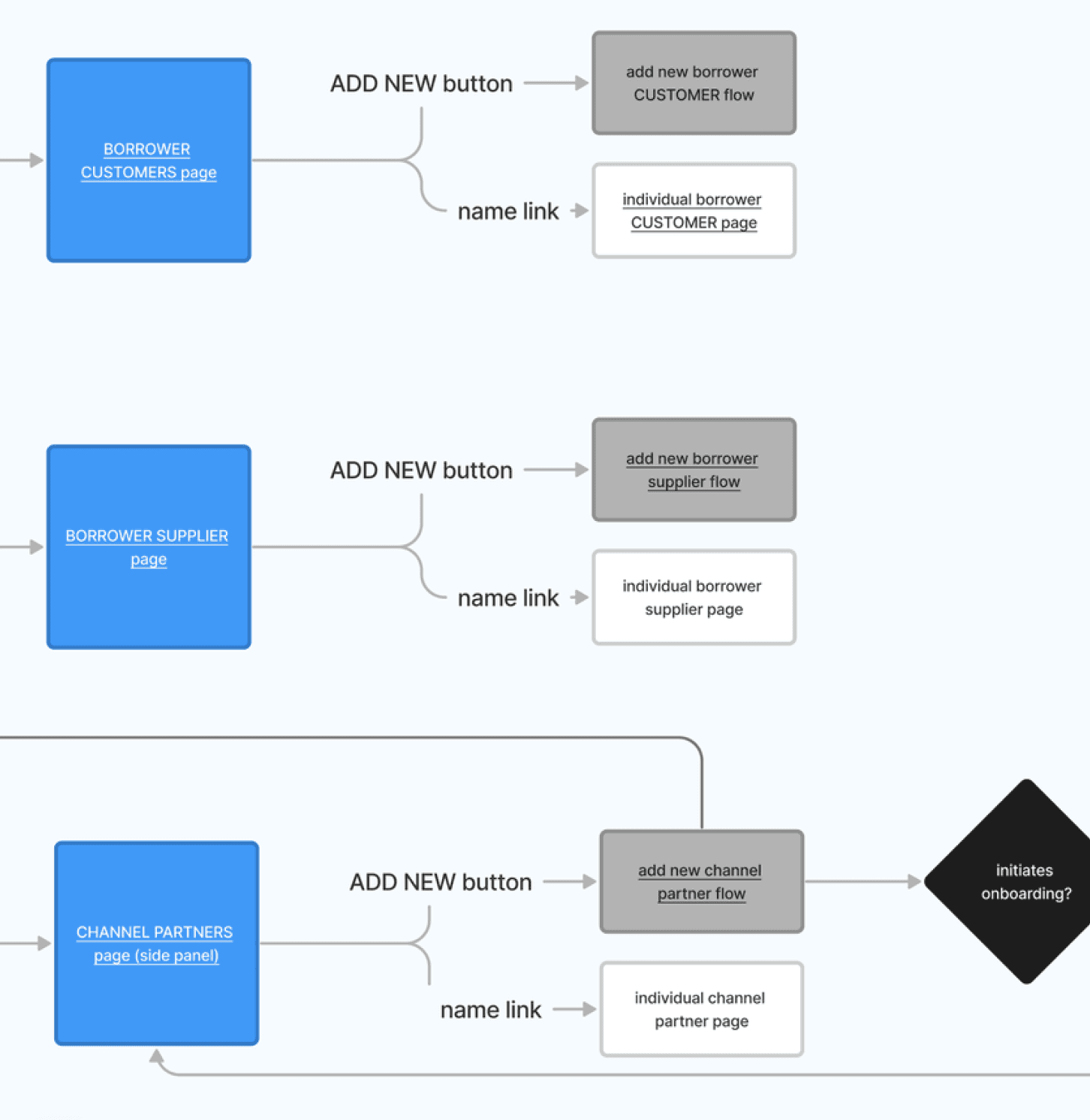

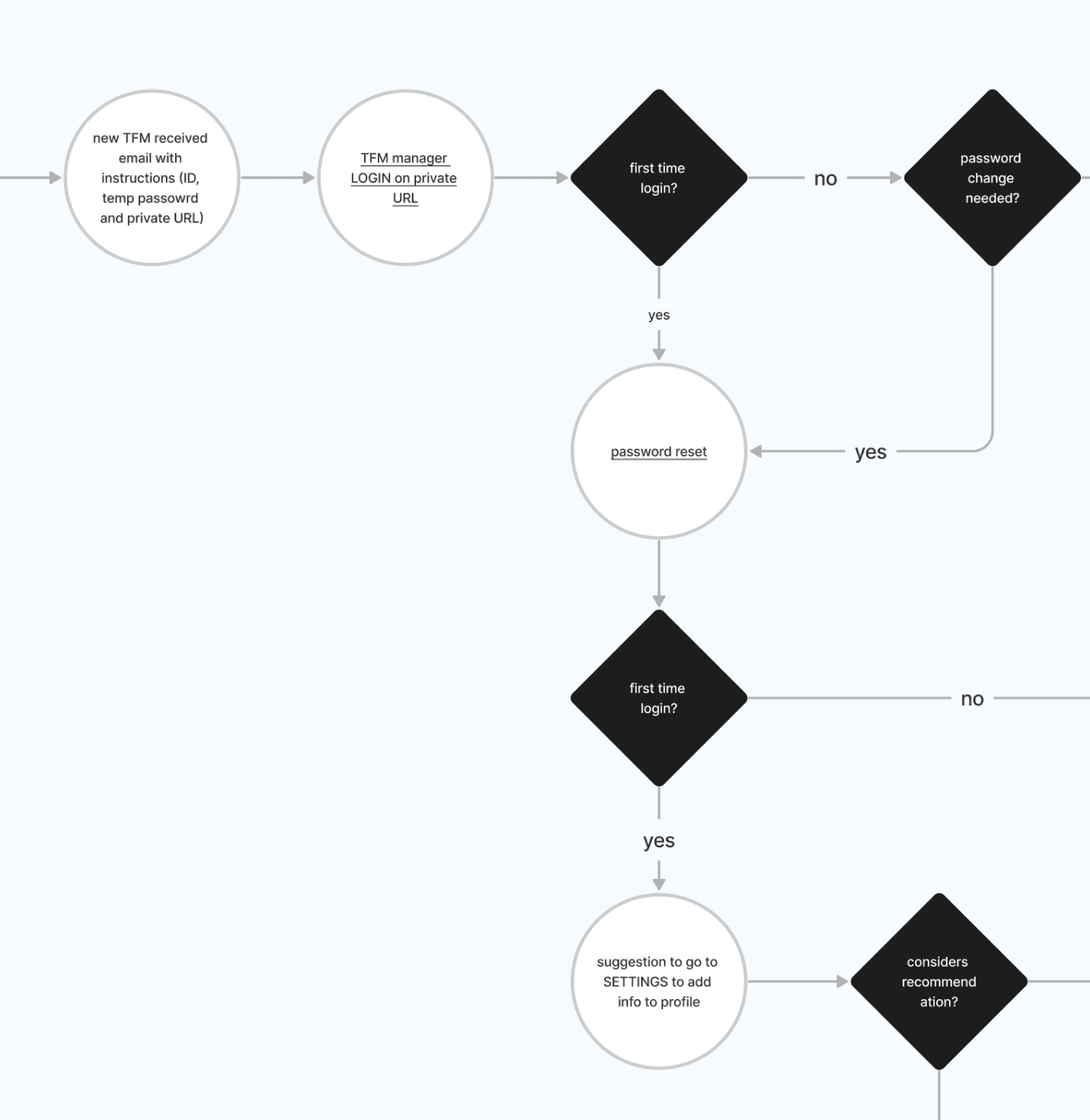

Given the complexity of both trade finance managers' and borrowers' workflows, I iterated through several design options to arrive at the final flow. Below you can find snippets of this process.

Prototyping

After sharing the research findings with the product team and discussing necessary adjustments, I began creating the initial designs.

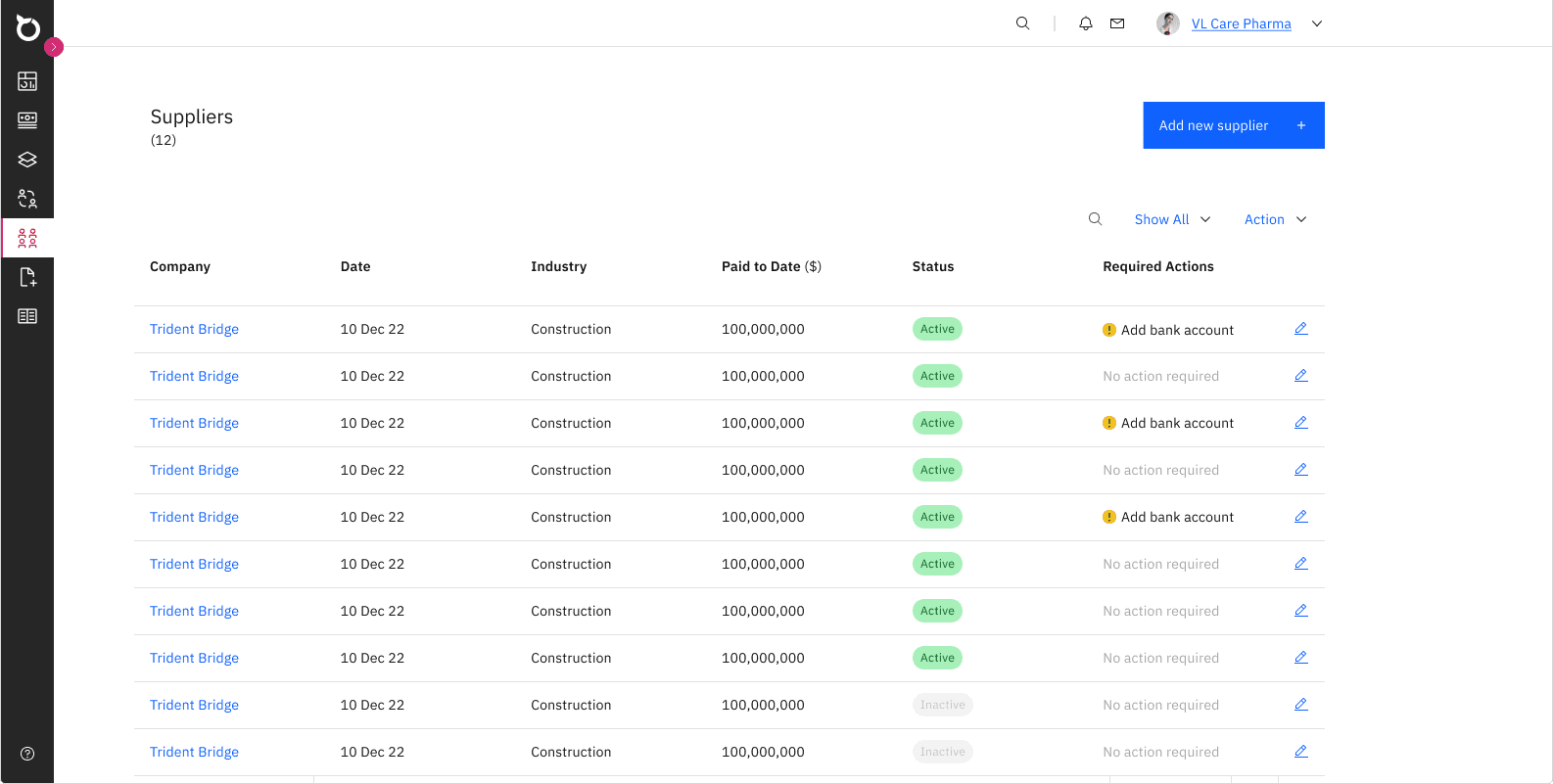

Here's a glimpse into the platform's design, to check more please click here.

Usability Testing

The testing conducted with trade finance managers and borrowers provided insights into the usability and functionalityof the platform. Participants provided feedback on areas for improvement and suggestions for enhancing the platform to better meet their needs.

Users were happy that we delivered a solution that could easily minimize the number of excel spreadsheets and mentioned that having a easy way to search for a specific information would save a lot of time.

Users liked that while onboarding, they had the information of all of the steps they needed to take to complete it and how long they would take.

Trade Finance Managers found the platform easier to store information and they don't need to write multiple emails to gather info from borrowers, they can just use the platform to do it in one click of a button.

Users told that the platform simplified a lot of manual processes and kept the information more organized and stored in the same platform.

Handoff

Due to the tight delivery timeline, the handoff to developers was phased. The design team prioritized platform areas by complexity and organized them accordingly. We then collaborated with developers and the product manager to define the development order for each phase.

Designs were documented with all necessary specifications for development. Regular meetings were held to review the design flows and address any developer questions. Following each development delivery, a UI review was conducted to ensure pixel-perfect implementation.

Looking to start a project or you need

consultation? Feel free to contact me.